Navigating Input Costs, Output Prices, and Inflation

by Jayci Bishop

As another crop year wraps up, everyone looks toward the future. Anyone in agriculture is acutely aware of the peak input costs the industry experienced in 2022. According to the United States Department of Agriculture, growers continued to feel the effects as net farm income is forecast to de- crease by 17.4% to $31.8 billion in 2023. What can we expect for 2024? Joe Outlaw, Ph.D., professor, extension economist, and co-director of the Agricultural and Food Policy Center, shared his insight on what growers can expect this coming year.

As another crop year wraps up, everyone looks toward the future. Anyone in agriculture is acutely aware of the peak input costs the industry experienced in 2022. According to the United States Department of Agriculture, growers continued to feel the effects as net farm income is forecast to de- crease by 17.4% to $31.8 billion in 2023. What can we expect for 2024? Joe Outlaw, Ph.D., professor, extension economist, and co-director of the Agricultural and Food Policy Center, shared his insight on what growers can expect this coming year.

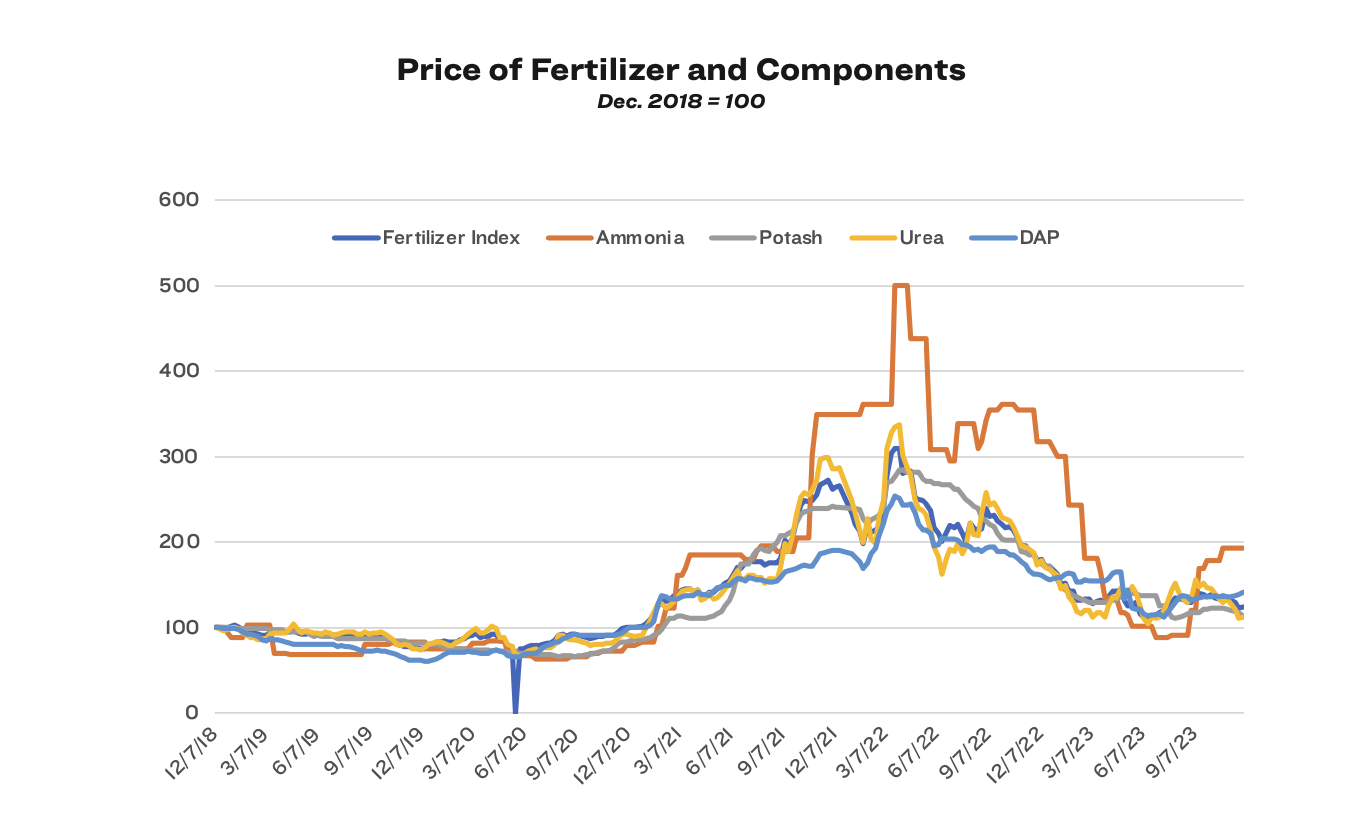

“Input costs have moderated somewhat from the peak levels experienced in 2022,” Outlaw said. “Based on my experience watching input costs over the past 30-plus years when most of the major commodity output prices jumped abruptly, it appeared that every input supplier decided it was time to stop holding the line on cost increases. The changes in 2022 were dramatic. Cost increases were much smaller in 2023 but still positive.”

Despite increased production expenses, some farmers remained profitable due to higher output prices. However, profit margins were much smaller than if input costs had not increased dramatically. Outlaw explained there is a variation of change among the different inputs.

“There are a number of cost categories that really don’t vary much year-to-year, like seed and some chemicals,” Outlaw said. “The only real place for significant changes in 2024 is in fuel and fertilizer, and there is about as much risk of prices going higher as there is a chance of going lower.”

Growers live this day-to-day and should pay attention to where costs will be. They also need to be mindful of fertilizer and fuel for equipment and irrigation and try to opportunistically purchase inputs when possible. USDA projects fuel costs to increase from $44.92 to $47.36 per acre in 2024, while fertilizer is projected to decrease from the forecasted 2023 level of $112.02 to $96.05 per acre in 2024.

“Unfortunately, input suppliers are quick to adjust upward when weather or international events signal supply change disruptions,” Outlaw said. “These are difficult to anticipate. However, my advice would be to stagger purchases if possible so that one of these events does not impact their entire quantity purchased.”

Input prices are only one part of a farmer’s balance sheet. It is also essential to look at the prices they can receive for the crops they grow.

“I think in the near term, my biggest concern is output prices,” Outlaw said. “The saying in economics is that input prices are sticky on the way down while output prices tend to be a lot more volatile,” Outlaw said. “My concern in the short run is that output prices are coming down, and it will greatly reduce if not eliminate farmer profits due to high input costs.”

Inflation is a general measure of the change in the price of goods and services, so farm-level cost changes are reflected in inflation estimates. However, the most significant impact of inflation is being felt at the bank.

“The biggest impact has been in the increase in the size of farmer operating loans,” Outlaw said. “Most farmers I talk to have seen the size of their operating loans increase significantly and, unfortunately, at significantly higher interest rates.”

Outlaw said he does not think interest rates will appreciably decline until the 2025 crop year. He also said it is important to remember the farm safety net’s benefits and take advantage of them.

“The farm safety net, as current- ly configured, does nothing to protect farmers from cost increases,” Outlaw said. “However, really using the safety net programs to protect output prices or even revenue will be critical going forward.”

It is vital to stay informed on in- dustry and market information. One resource for that is the Southern Ag Today newsletter.