June 27, 2025

Cotton prices were firm this week despite subdued export sales and geopolitical tensions, while also being supported by technical momentum and a weaker dollar. With uncertainty still high and key reports on deck, will the market find clearer direction in the days ahead? Get QuickTake’s read on the week’s events in five minutes.

Cotton futures advanced in the last week of June, supported by technical buying and reduced trade pressure following the July contract’s First Notice Day.

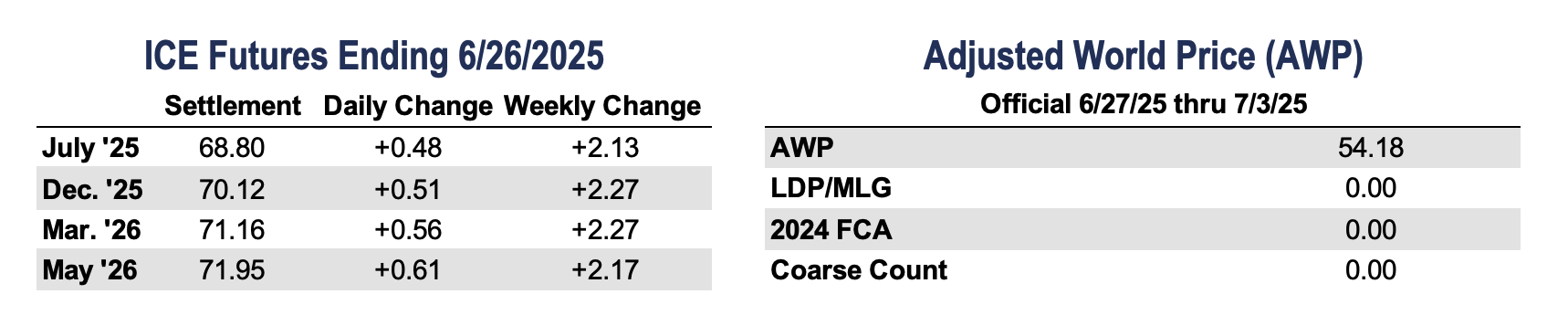

- December futures closed at 68.80, climbing 213 points for the week, reaching a high of 69.10 at one point.

- Technical momentum helped lift prices as December futures broke through key moving averages. The latest CFTC Cotton On-Call report showed a sharp drop in the imbalance of unfixed purchases to sales, pointing to active grower fixations ahead of July First Notice Day. Market attention now turns to Monday’s USDA Acreage Report, with analyst estimates averaging 9.7 million planted acres, slightly below the March figure of 9.867 million. The report is expected to be a key driver of sentiment as the market heads into July.

- Trading volume was moderate this week, and open interest fell by 13,393 to 204,516, the lowest level since April 2024. Certificated stocks fell 1,196 bales to 61,136 bales.

Markets held firm this week as investors weighed cooling inflation data, mixed corporate earnings, and renewed uncertainty around global interest rate paths.

- With just days remaining before July 4, the White House is pushing Congress to finalize its sweeping budget reconciliation package, but new procedural hurdles in the Senate are complicating the timeline. A ruling by the Senate Parliamentarian removed key Medicaid-related savings from the bill, forcing GOP leaders to scramble for new offsets. As Senate Finance works to rewrite the provisions, the tight schedule and potential House-Senate disagreements could jeopardize the administration’s self-imposed Independence Day deadline.

- The U.S. dollar index continued to tumble, hitting an over 3-year low on weaker Q1 GDP data revision, a wider trade deficit, and speculation that Trump may fast-track his Fed chair pick. This could be the worst first half for the dollar since 1973. The weaker dollar is broadly supportive for commodities, adding a tailwind to U.S. exports.

- The Personal Consumption Expenditures (PCE) price index, the Fed’s preferred measure of inflation, for May was in line with expectations at 2.3%. However, core PCE (PCE excluding food and energy) rose to 2.7% slightly above the expected 2.6%.

- Markets opened the week rattled by U.S. strikes on Iranian nuclear sites, sparking fears of wider conflict and driving oil prices sharply higher. However, limited Iranian retaliation and reports of a tentative cease-fire quickly shifted the narrative, with speculation that Washington had advanced knowledge of Tehran’s measured response. Oil prices, which initially spiked, later dropped sharply as tensions eased and the risk of escalation faded.

- The U.S. and China have finalized a trade agreement regarding the terms reached in Geneva. The White House aims to finalize agreements with 10 major trading partners, with President Donald Trump set to complete deals in the coming two weeks. This is ahead of a July 9 deadline to reinstate higher tariffs.

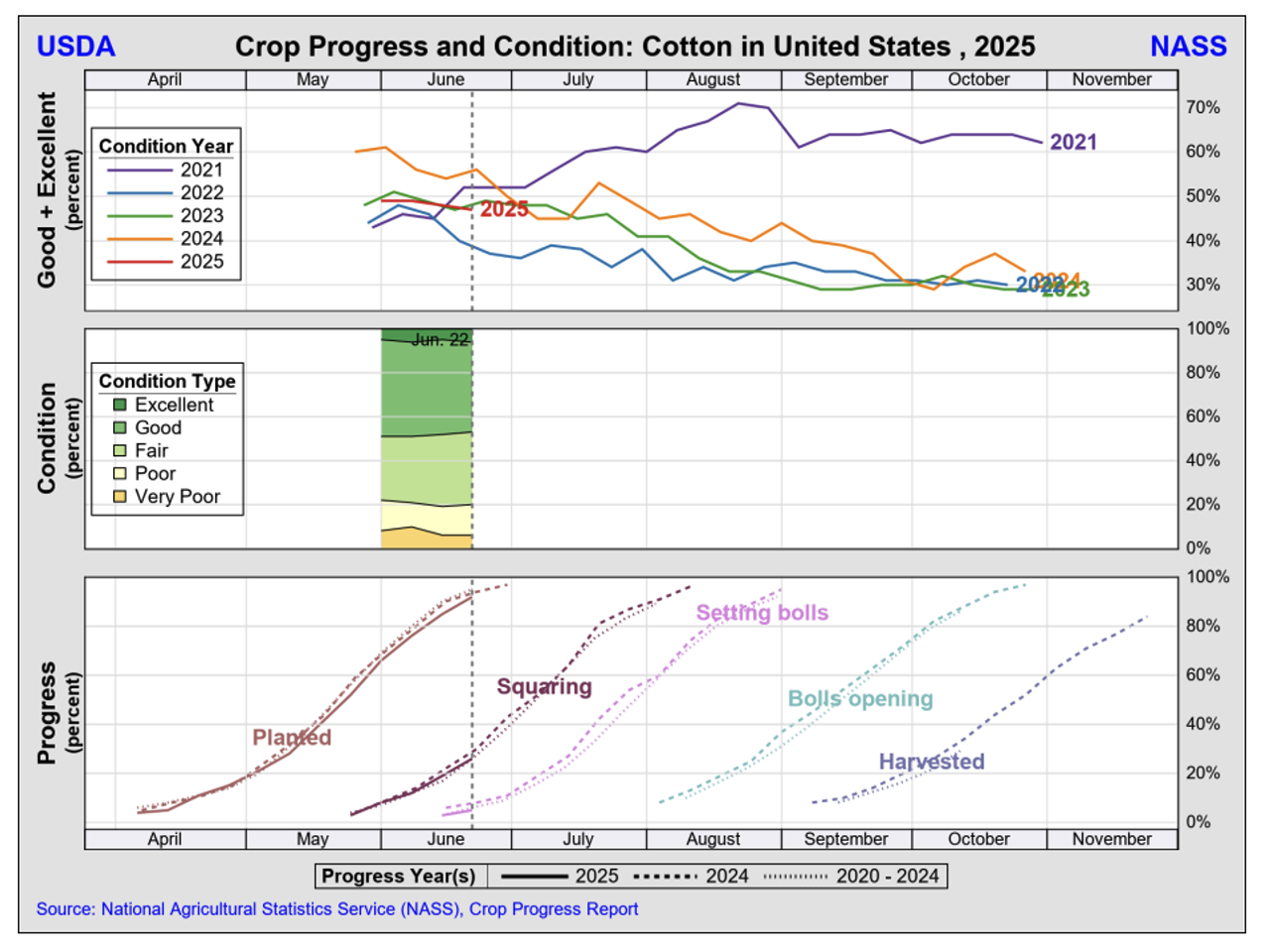

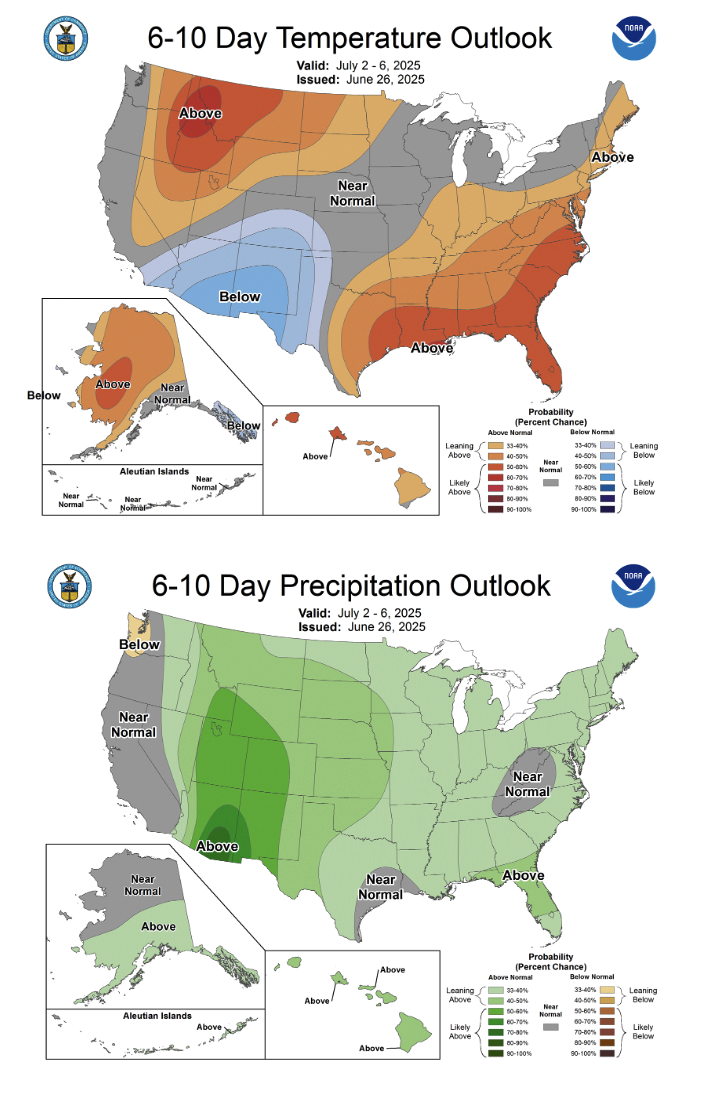

Planting across the Cotton Belt has almost been completed, and attention will continue to focus on weather.

- Squaring is progressing steadily, with Texas at 26%, Oklahoma at 5%, and Kansas at 5%. Boll setting has begun in Texas (8%).

- Crop conditions remain mixed across regions. In Texas, just 35% of the crop is rated good to excellent, Kansas is 32%, and Oklahoma fares better at 67%. The Mid-South, Southeast, and Far West are generally in better shape, but persistent early-season rainfall and cooler temperatures continue to affect stand quality and development in several states.

- Light rain in West Texas allowed fieldwork to continue, but timely moisture will be key to supporting development as the crop enters fruiting. In South Texas, improved soil conditions have aided progress, with bolls beginning to crack in the Rio Grande Valley and more rain expected in the Upper Coastal Bend. Scattered storms are forecast for both regions, offering much-needed moisture during a critical stage. While precipitation in West Texas will be lighter, South Texas may see more meaningful rainfall in the days ahead.

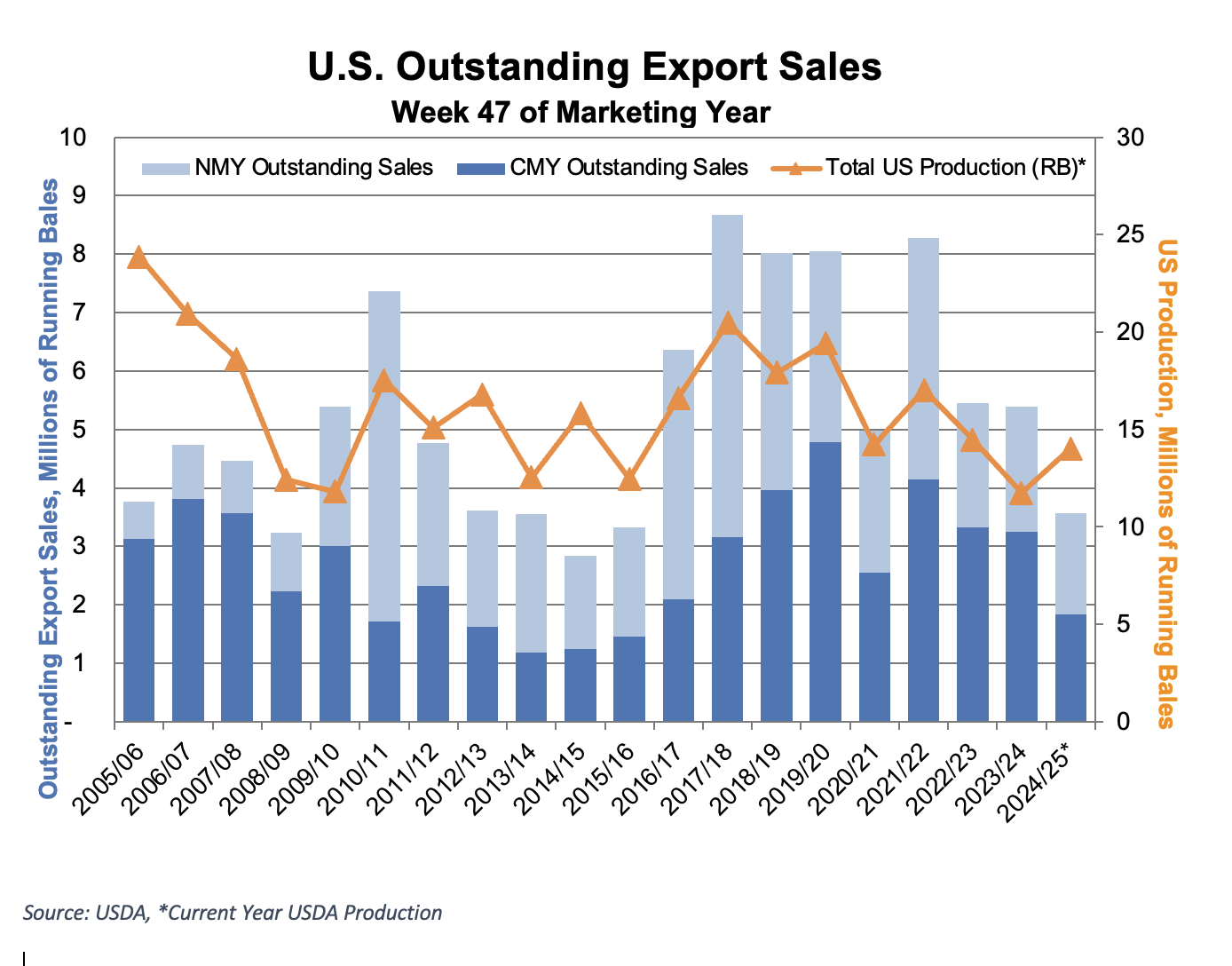

U.S. export sales remained sluggish for the week ending June 19, while new crop demand was subdued.

- Current crop Upland sales were uneventful, totaling just 27,300 bales—a 67% drop from the prior week and well below the 4-week average. New crop sales came in at 64,700 bales, a slower pace than last week, with Vietnam, El Salvador, and Malaysia as the top buyers.

- Export shipments fell to 184,500 bales, which remain above the pace needed to meet USDA projections. To reach the 11.5 million bale estimate, exporters must continue averaging at least 150,000 bales per week.

- Pima activity was limited, with net sales of 1,800 bales for the 2024/25 season. While sales were modest, exports climbed to 8,000 bales.

The Week Ahead

The Week Ahead

- Markets will be closed Friday for Independence Day, but the shortened week still brings several key reports. In cotton, attention will center on Monday’s USDA Acreage Report and Crop Progress Report, followed by Thursday’s Export Sales. Broader markets will be watching Thursday’s unemployment report for signals on labor market strength and future Fed policy.

- The QuickTake will return on Thursday, July 10, following the holiday-shortened week. Until then, we hope you enjoy a safe and relaxing long weekend.

The Seam

The Seam

As of Thursday afternoon, grower offers totaled 38,325 bales. There were 3,075 bales that traded on the G2B platform, which received an average price of 64.64 cents per pound. The average loan for these bales was 53.31, bringing the average premium received to 11.33 cents per pound.