March 9, 2026

The Week Ahead

This week is shaping up to be driven far more by macro forces than traditional agricultural fundamentals, as the war in Iran has ignited a sharp increase in energy markets and triggered broader commodity buying.

- Energy markets are setting the tone across commodities right now. Brent crude jumped more than 27% last week, the largest weekly increase since 2020. Large inflows into crude have begun spilling into agricultural markets as investors adjust positions and respond to rising inflation expectations.

- Attention now shifts back to inflation and the Fed. Last Friday’s Nonfarm Payrolls report came in weaker than expected. Markets will now be watching Wednesday’s CPI and Friday’s PCE report for the next signal on inflation ahead of next week’s Federal Reserve meeting. While the data reflects February inflation, the recent surge in energy prices means markets will likely focus more on what it implies for inflation going forward.

- Overall, the week is relatively light on major economic releases but still heavy on policy and global headlines. The focus has shifted toward how much of the Iranian risk markets will need to absorb, with price direction likely to follow developments as the situation unfolds. Updated cotton supply and demand estimates are due next Tuesday, followed by the March Prospective Plantings Report at the end of the month.

Looking ahead, market attention is beginning to shift toward upcoming USDA reports, including Tuesday’s March Supply and Demand Estimates (WASDE) and the Prospective Plantings report later this month. While the March WASDE is not typically a major market mover, traders will still be watching for any adjustments to U.S. export projections or ending stocks as the market continues to gauge demand. For now, broader macro developments and fund flows appear to be setting the tone across commodities, with energy markets continuing to lead the move.

Market Recap

- Cotton futures faced pressure this week as escalating geopolitical tensions and continued macro uncertainty gave jitters to would-be textile mill customers. May futures fell 141 points on the week, settling at 64.20 cents per pound.

- Markets spent much of the week reacting to escalating tensions in the Middle East as the conflict between the U.S. and Iran intensified. Reports surrounding potential shipping disruptions, particularly through the Strait of Hormuz, added another layer of uncertainty to global markets. The U.S. Dollar strengthened throughout the week, creating additional headwinds for agricultural markets, while energy prices and gold moved higher amid geopolitical risk. Despite strength across much of the commodity space and greater-than-expected short covering by speculators, cotton moved lower and failed to keep pace with gains in crude oil and the grain complex.

- On-call activity was also the most supportive it has been in some time. The latest CFTC Cotton On-Call report showed the imbalance between unfixed sales and purchases narrowing further to its smallest level in over a year. Unfixed sales increased while unfixed purchases edged slightly lower, continuing the trend of growers using the recent rally to price additional cotton.

- Trading activity stayed strong throughout the week, with solid participation across the board. A total of 600 delivery notices were issued against the March contract. Open interest decreased by 2,574 contracts to 326,278, while certificated stocks continued to build, increasing 3,124 bales to 129,302.

Economic and Policy Outlook

Economic and Policy Outlook

- Oil markets surged as tensions in the Middle East intensified, briefly pushing Brent crude above $119 per barrel, the highest level since 2022. The rally is being driven by concerns over supply disruptions, particularly with the Strait of Hormuz largely shut and several major producers reportedly cutting output. Market structure is also signaling tight conditions as traders compete for immediate supply. If disruptions persist, higher energy prices could continue to support the broader commodity complex while adding to inflation concerns and overall market volatility.

- The U.S. labor market showed signs of weakening in February as nonfarm payrolls fell by 92,000, sharply missing expectations for a gain. The unemployment rate edged up to 4.4%, and prior months were revised lower by another 69,000 jobs, pointing to softer hiring trends overall. Job losses were seen across several sectors, with the biggest declines seen in manufacturing and health care. While wage growth remained steady, the report suggests the labor market may be losing some momentum, a trend markets will be watching closely as upcoming inflation data and the next Federal Reserve meeting help shape the outlook for the broader economy.

- The House Agriculture Committee advanced the Farm, Food, and National Security Act of 2026, often referred to as the “skinny” farm bill, by a 34–17 vote following a lengthy and partisan markup. All Republicans and seven Democrats supported the bill, sending the legislation to the House floor as the first step toward reauthorizing U.S. farm policy. Debate highlighted differences over conservation funding, trade policy, and nutrition programs. The bill now heads to the House floor, where its path forward remains uncertain as leaders work to secure enough support for passage, and the Senate is expected to develop its own version before a final farm bill can be approved.

Supply and Demand Overview

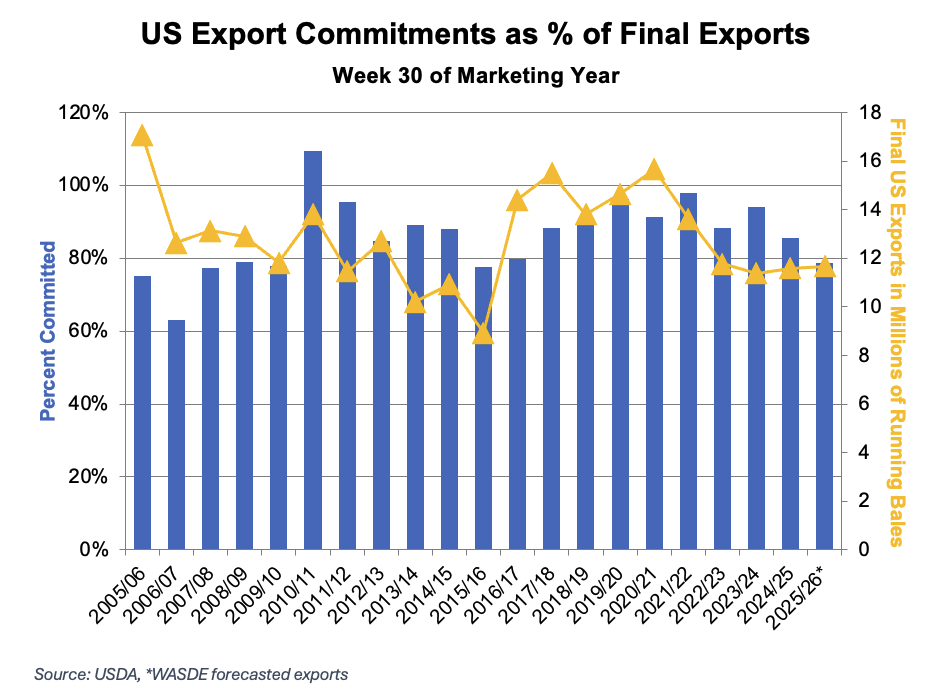

- Export sales slowed from the previous week but remained respectable overall. Net Upland sales totaled 150,400 bales, with an additional 54,600 bales booked for the next marketing year. Vietnam led the way in purchases, followed by Pakistan, Mexico, India, and Indonesia. Shipments improved noticeably, reaching a marketing-year high of 282,200 Upland bales along with 12,400 Pima bales. While exports moved closer to the roughly 300,000 bales needed each week for the U.S. to reach USDA’s 12 million bale projection, shipments remain a concern as the market continues to look for more consistent demand and stronger movement in the weeks ahead.

The Seam®

The Seam®

- As of Friday afternoon, grower offers totaled 43,913 bales. The past week, 6,738 bales traded on the G2B platform received an average price of 60.09 cents per pound. The average loan redemption rate (LRR) was 51.81, bringing the average premium over the LRR to 8.28 cents per pound.

Note: The Loan Redemption Rate (LRR) is the loan rate minus the current Loan Deficiency Payment (LDP).

Sustainability Enrollment Opportunities

Sustainability Enrollment Opportunities

- Enrollment for the U.S. Cotton Trust Protocol will be open January 5th- April 30th, 2026. Growers who are currently enrolled will need to renew their membership to continue their involvement in the program. If your gin would like to host an Enrollment Field Day during this time, please reach out to PCCA at (806) 763-8011. Click here for a list of in-person sign-up dates.

- New Grower Enrollment for the Better Cotton Initiative will be open from March 3 to May 30. Growers interested in joining this global sustainability program should contact PCCA (806) 763-8011.