U.S. Faces Production Challenges as Brazil Surpasses Production, Global Demand Uncertainty Looms

by Abigail Hoelscher

The world’s largest cotton-producing countries are typically China, India, and the United States. The U.S. is known for high-quality cotton due to seed breeding development and standards set by USDA. Before 2000, the U.S. consumed a large portion of the cotton it produced, but over the past two decades, we have become a structural exporter, routinely shipping 80% or more internationally. China has become increasingly dependent on cotton imports, mainly U.S. cotton. The COVID-19 pandemic collapsed global consumption, reaching lows not seen since the 2011/2012 crop year. Businesses in China were slow to open, and the need for cotton within the country slowly started to recover. Cotton consumption has rebounded to more normal levels this year, but economies worldwide are now feeling pressure from rising inflation.

In November, the USDA supply and demand report estimated 115.5 million bales of cotton to be consumed across the globe. Global use is up significantly compared to last year but is still below the 10-year average of 115.7 million bales. The number has been revised modestly downward on each release of the estimates since the 2023/2024 marketing year began. As economies slow down, consumers spend less on discretionary goods, including cotton. Mills throughout the world are purchasing cotton hand-to-mouth and not operating at capacity. Slowing economies and as-needed purchasing are issues that could impact global demand for fiber.

In November, the USDA supply and demand report estimated 115.5 million bales of cotton to be consumed across the globe. Global use is up significantly compared to last year but is still below the 10-year average of 115.7 million bales. The number has been revised modestly downward on each release of the estimates since the 2023/2024 marketing year began. As economies slow down, consumers spend less on discretionary goods, including cotton. Mills throughout the world are purchasing cotton hand-to-mouth and not operating at capacity. Slowing economies and as-needed purchasing are issues that could impact global demand for fiber.

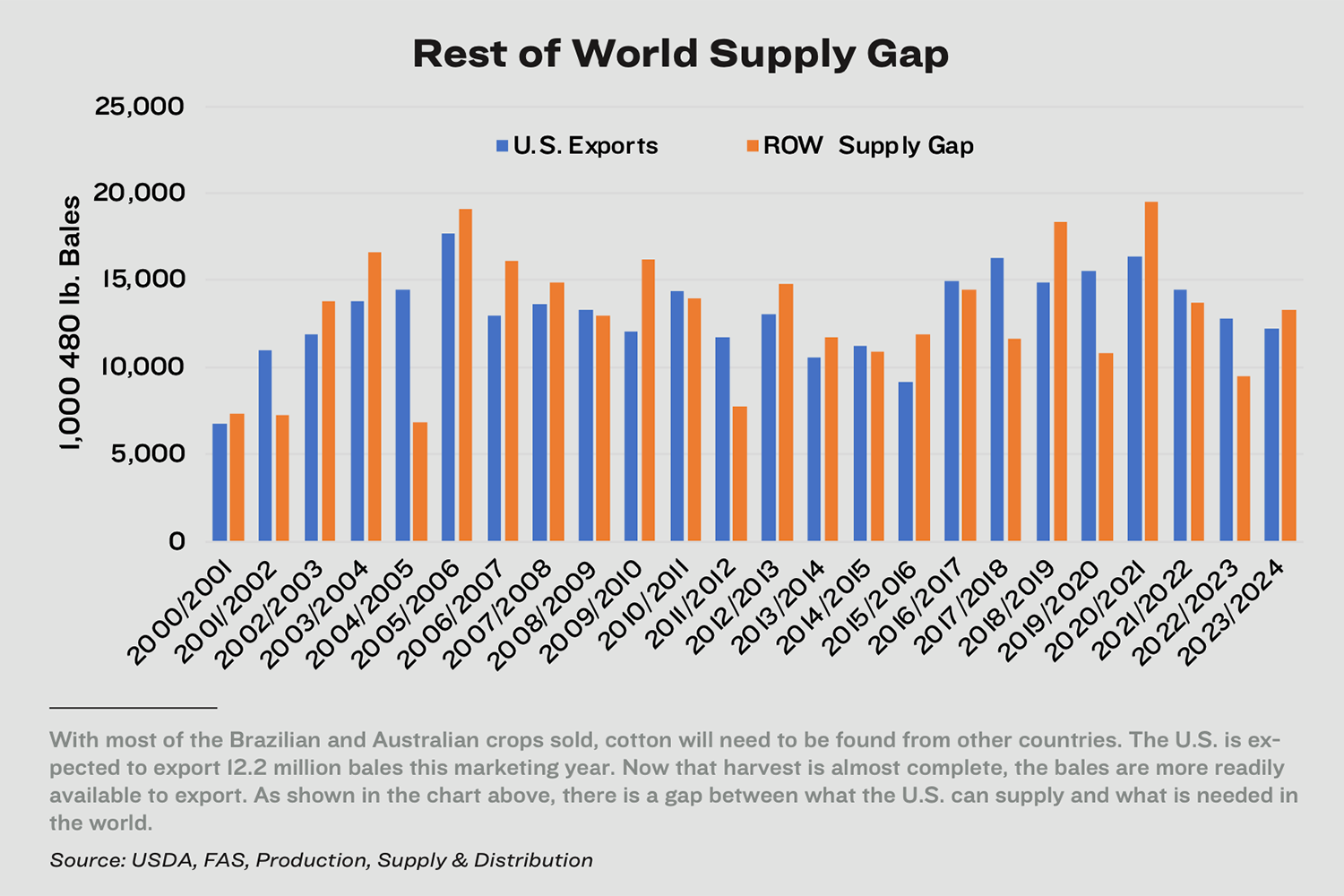

The U.S. also has more competition from foreign growths than ever before. The U.S. has experienced back-to-back short crops, while significant competitors have had re- cord-breaking production. Despite its high-quality, contamination-free reputation, lower-priced competitors have undercut U.S. cotton, chiefly Brazil and Australia. In the southern hemisphere, these countries typically plant the new crop while the U.S. is harvesting. The market timing of their cotton has created additional pressure on U.S. bales, especially with mills buying hand-to-mouth recently. Add that to the expensive U.S. basis early in the season, and American cotton fell back in rank.

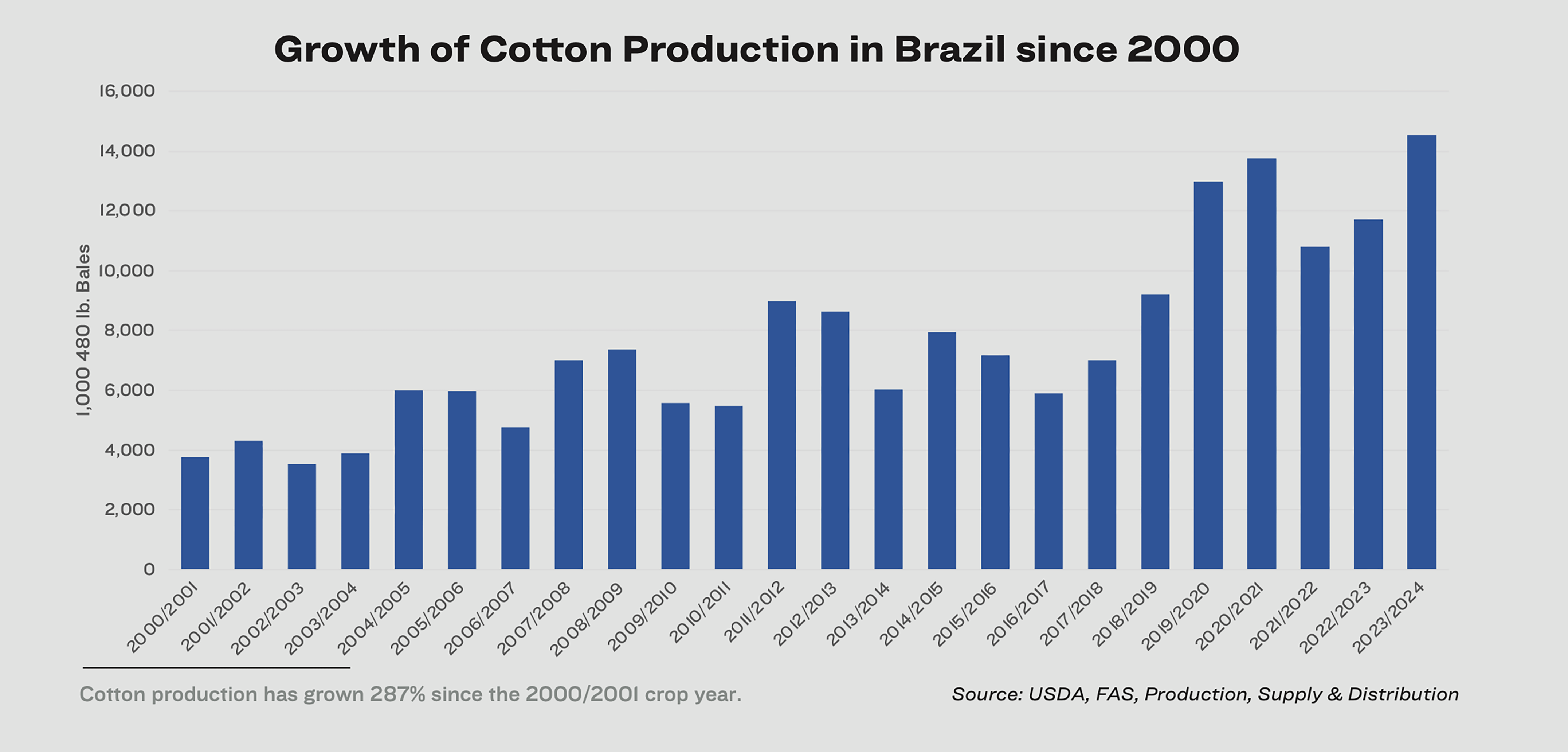

In October of this year, Brazilian production surpassed that of the U.S. as the third-largest grower of cotton in the world. In the past 10 years, Brazil has significantly increased the number of acres planted to cotton. A large portion of cotton in Brazil is planted after the soybean crop is harvested, meaning most of the cotton is grown as a second-season crop. Improvements in infrastructure and research on the quality of seed used in Brazil have helped the rise in production. Farmers in the country have been able to invest substantial amounts of money into equipment used to plant, harvest, and gin the amount of cotton now produced.

Much like Brazil, Australia has received favorable weather the past few years, producing record-sized crops for three consecutive years. Exports from Australia are typically less than half the size of what the U.S. will export. Still, recent improvements in cotton seed and expansion of production have allowed the country to grow exports. Much like the Southwestern portion of the U.S., cotton grown in Australia can increase production each year due to water availability. Water has been more readily available in the last three seasons from above-average rainfall. The above-average moisture has allowed more water to be stored, allowing for another large crop in the upcoming year.

The 2023/2024 U.S. cotton marketing year has not been what many anticipated and needed. A second year of severely hot weather and limited rainfall took its toll on the cotton crop in the Southwest. The combination of production woes with slow demand means the 2023/2024 crop will be another historically lousy season. The macroeconomic environment will be one of the main factors influencing the future of cotton. U.S. retail sales have increased month-over-month multiple times this year, but the apparel sector has decreased during those same months. The U.S. dollar has remained high for much of the year, making it difficult and expensive for countries to import U.S. cotton. One positive is that the Australian and Brazilian basis is closer to the U.S. With much of their crops sold, mills needing to purchase cotton will look to the U.S. crop. Now that harvest is wrapping up in the U.S., the crop will be the most readily available to the market. The question is not “if ” but “when.”