If you have recently gone to the grocery store or fueled your vehicle, you’ve experienced inflation firsthand. In February, food prices increased 8% year-over-year while a tank of gas cost 47% more. The same economic conditions pushing food and fuel prices higher also affect the cotton market. March ’22 cotton futures ranged from 55.52 cents per pound to 129.37 cents per pound during the life of the contract. Recently, cotton traded on The Seam for more than $1.30 per pound. Why are prices so high? More importantly, do we expect them to stay high for the upcoming crop year?

The Mighty Consumer

In the Spring of 2020, COVID-19 rocked the global economy and destroyed millions of jobs. Governments worldwide created massive economic stimulus programs to save the economy from total collapse.

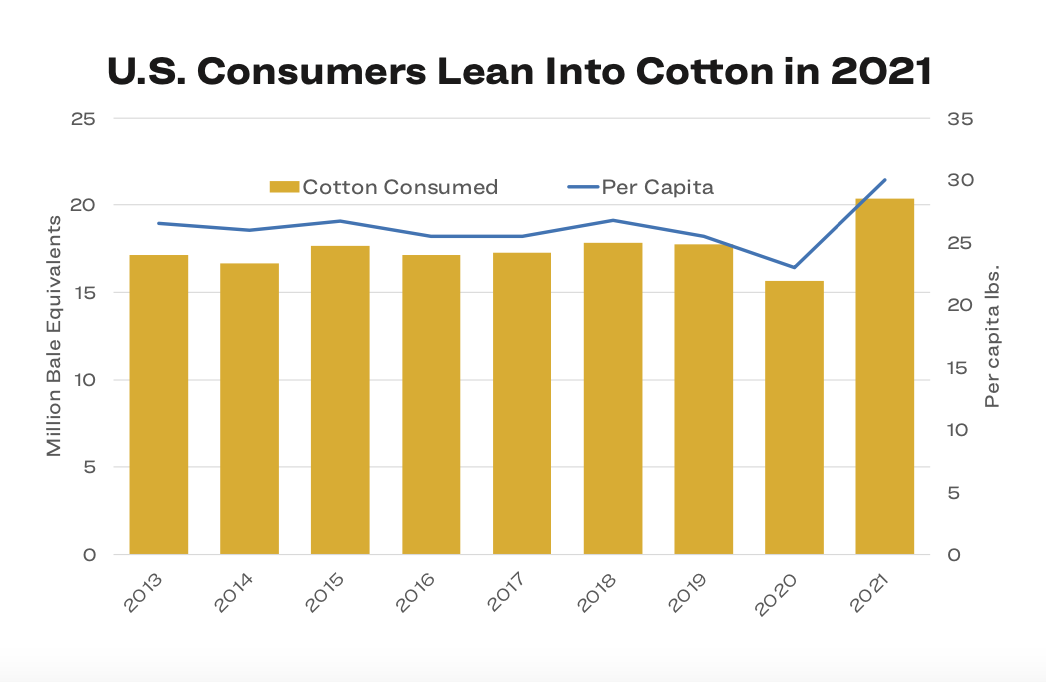

Consumers used the found money to go shopping. They couldn’t go to restaurants or go on vacation, but they could buy clothes. Many people who had become accustomed to working at home switched their clothing style to more comfortable, cotton-rich clothing like jeans, sweats, t-shirts, and hoodies. The pivot to comfort wear, coupled with a growing preference for natural fibers, boosted cotton’s share of U.S. textiles in 2021. U.S. cotton textile and apparel imports rebounded 30 percent to 21.2 million bale equivalents in 2021, while synthetic product imports rose 15.5% during the same period. Home textiles benefitted as people looked for more comfortable surroundings during lockdowns.

The sudden surge in consumer demand for goods depleted textile manufacturers’ inventories. With little competition from burdensome stocks, manufacturers increased their prices, generating solid profits. However, it did not last. Current cotton futures prices are causing textile mills to evaluate whether they can still make money on yarn. Where possible, mills increase synthetic fibers into their blends or just slow down operations.

The Manufacturers’ Dilemma

Another consideration is the difference between current crop futures and new crop. The July contract is trading at a hefty premium to December. Known as an “inversion,” the higher nearby price compared to the lower December contract has mills wishing they could wait and price their cotton later. But not many have the choice to do so.

There is an old saying, ‘The cure for high prices is high prices.’ This year’s market has attempted to find the prices that will reduce demand, and those levels may be getting closer. That doesn’t mean that current crop July futures cannot continue much higher. Speculators could return to the market as buyers, exacerbating the supply shortage and squeezing the many textile mills that have yet to price their cotton. Outstanding on-call purchases, where mills have committed to buy but not yet called the price, are at record levels. Eventually, they will have to price or roll their purchases forward, which will result in buying futures. Fundamental analysis of the market also shows a mixed picture. Although the 2021/2022 marketing year started with plenty of cotton–most of it in the wrong place. For instance, a majority of the world’s ending stocks are in the Chinese

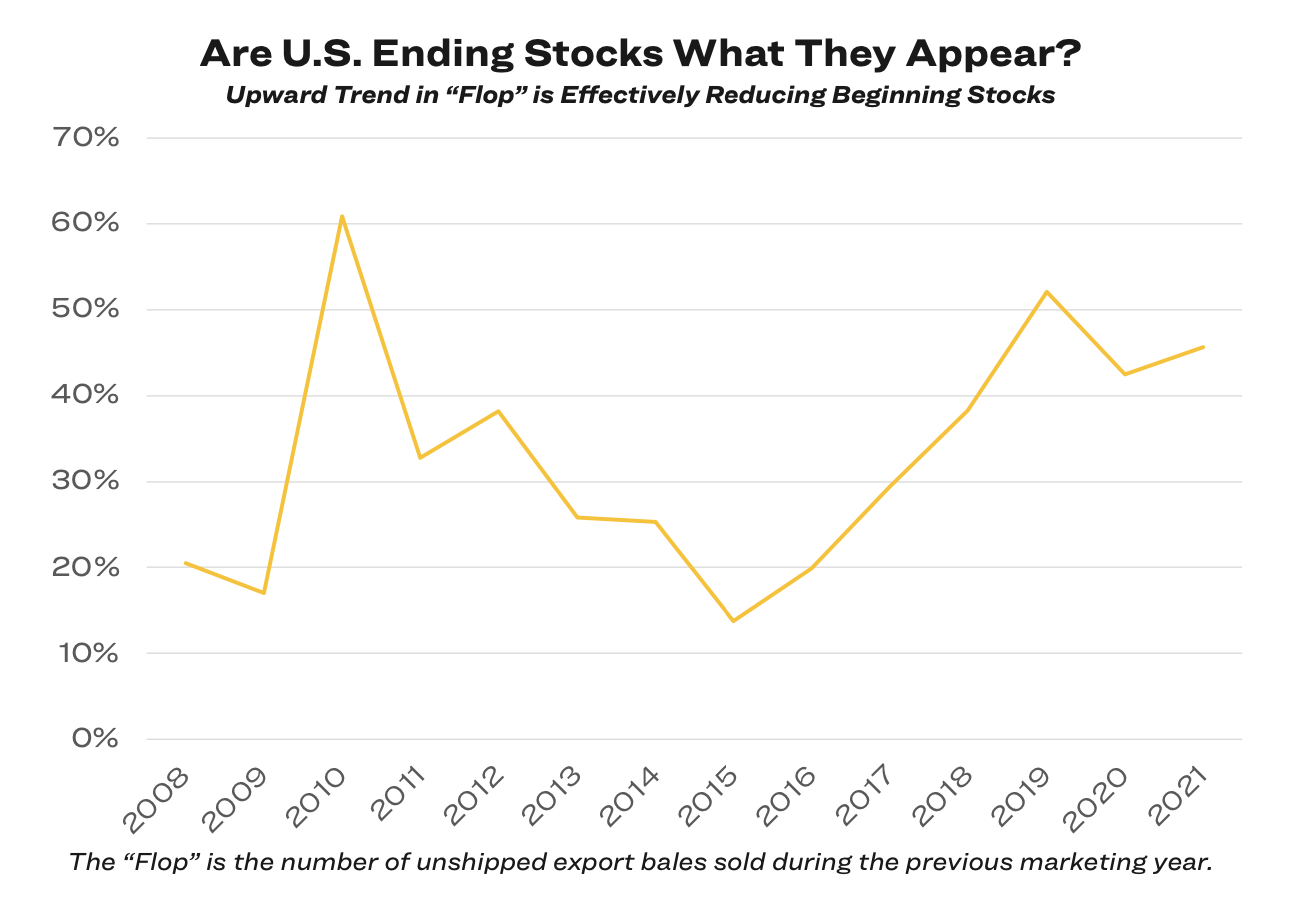

Reserve and are not going anywhere. USDA’s April World Agricultural Supply and Demand Estimates (WASDE) estimated that U.S. ending stocks (i.e., the total number of bales existing in the country on July 31) will be 3.5 million bales. That is a relatively tight ending stock level, especially given a significant amount of it is already sold. Outstanding (unfulfilled) export sales on July 31 are carried into the next marketing year, and this quantity is often called “the flop” or “carryover sales.” In tight years, much of the beginning stocks are already committed right out of the gate. With world demand expected to exceed supply, U.S. cotton is positioned to fill the gap.

Which Way from Here?

Can the cotton market sustain this level? It looks like there could be enough cotton in the world on paper. But once again, it won’t be in the right hands, at the right place, or at the right time. And continued supply chain troubles should be added to that list. Many of the world’s mills are still running hand-to-mouth on lagged shipments. Logistics and down-stream demand continue to play into very good support for prices. It is also the reason why the market is inverted. Essentially, the market is saying it needs cotton now, not later.

With the global supply and demand imbalance set to be tight again, the U.S. will be the residual supplier of cotton to the world. Short of a major geopolitical shock, tight, “flop”-adjusted ending stocks and a dim production outlook have set the stage for another year of high demand and low supply. And that could easily keep prices higher for longer.